When we are looking to buy a home, we put all of our focus on saving up for the downpayment and oftentimes overlook other fees that are required to close the mortgage.

These fees come in a bundle called closing costs, and mortgage lenders charge them for their services and expenses. If you did not account for these costs, it can postpone your home purchase until you secure the amount.

Can you close the mortgage without paying the closing costs?

Well, the simple answer is no. Closing costs come with the mortgage and must be paid in order to acquire the loan. No one works for free. There are multiple working hands, and all parties must be paid. The interest alone is not enough to pay for all.

Can you roll closing costs into a mortgage?

Closing costs can be rolled into your mortgage by either increasing your loan-to-value (LTV) or getting a “seller’s concession”. These alternatives may seem attractive as you’re ending up paying less out of pocket. However, make sure that you haven’t exceeded the maximum allowable loan-to-value (LTV) and debt-to-income ratio (DTI) limits.

I was also on the same boat as most people who didn’t plan for the closing costs. Due to this, I did a lot of research to find out the best ways to include closing costs in my mortgage. In this article, I am going to share all my findings and also provide my recommended approach.

Let’s dive right in.

What are Closing Costs?

Closing is the stage in the house buying process when the previous property owner transfers the title over to you, the new owner. At this point, the buyer has to pay the fees for the services and expenses for finalizing the mortgage. These are the Closing costs and can run between 2% to 5% of the home’s market value.

To give an example, if the home is valued at $400,000, you can expect to pay somewhere between $8,000 and $20,000 in closing costs. Here is a closing cost calculator by SmartAsset that you can use to get an estimate.

When you initially submit your loan application, your lender will provide you with a loan quote that includes the terms, estimated mortgage payments, and closing costs.

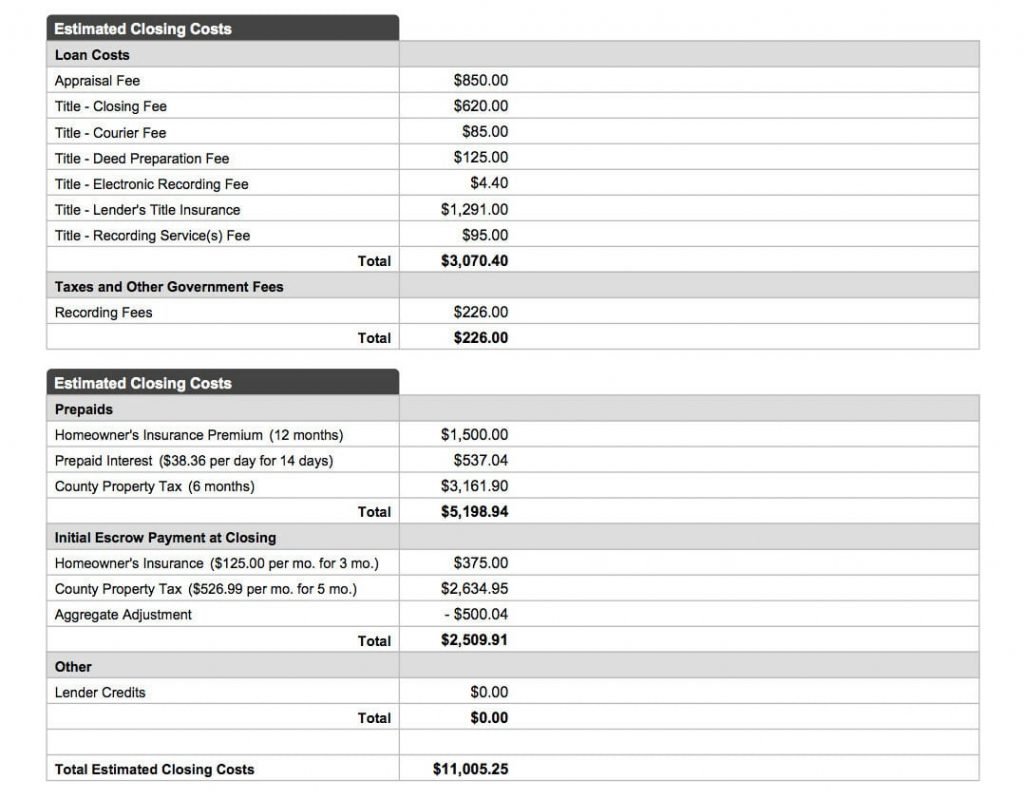

Here is a sample estimated closing cost breakdown for a home purchase price of $400,000 2-unit duplex with 20% downpayment and no mortgage points in Pierce County, Washington state. It can give you a ballpark estimate of the fees that you can expect in your loan quote.

What do Closing Costs include?

Closing costs include a myriad of fees that are charged by lenders for their services. It is very important to understand what they are and if you are being charged fairly.

Application Fee

This fee varies from lender to lender, but often costs between $200 to $500. You don’t have to pay this fee when you’re shopping around for a. Mortgage. Once you finalize on a lender, you’ll have to pay this amount at closing.

Appraisal Fee

This is a mandatory fee that goes to a professional appraiser to ensure if the home is worth the sale price. The cost is often around $300 to $500, but it may be higher for larger houses, multi-family properties or houses in remote areas.

Title/Attorney Fees

A title company ensures that the title to the home is free and clear – that no one else has any claims to the property. It also includes mandatory lender’s title insurance and other expenses related to transferring the deed. You are free to shop for the lender’s title insurance, but most people go with the one recommended by the lender.

The cost of title and attorney can vary from state to state but is usually about 1% of the loan amount.

Recording Fee

This is a fee charged by your local government to record the purchase transaction of your new home.

Mortgage Discount points

This fee is paid at closing to the lender for a reduced interest rate. This is a lump sum that you pay upfront in order to “buy down the rate” for the length of the loan term. These are charged as a percentage of the loan amount. So, if your loan amount is $300,000, one mortgage discount point would be equal to $3,000.

Private Mortgage Insurance (PMI)

If your downpayment is less than 20 percent, you’ll likely have to pay PMI. PMI typically costs between 0.5 to 1 percent of the loan amount annually, though your premium will vary depending on the value of your home, your credit score, and your downpayment. You’ll likely have to pay a portion of this premium at closing.

Homeowners Insurance

When you are taking a mortgage, the lenders will mandate you to carry homeowners insurance at all times. At closing, the buyer typically pays the premium for the first 12 months.

Prepaid Interest

This is daily interest that accrues on the loan between the closing date and first monthly mortgage payment. Sometimes the seller reimburses these costs as it is in their best interest to close as soon as possible.

Property taxes

At the closing of the home sale, the buyer typically pays the city and county property taxes from the date of closing through the end of the tax year.

Can you Roll Closing Costs into a mortgage?

If you noticed the types of fees mentioned above, most of them are mandatory and must be paid in full at closing.

Now, what if you are in a situation where you do not have any money saved up for closing costs. How would you still close the mortgage?

Roll closing costs into a mortgage

One way to avoid paying closing costs upfront is by rolling it into the mortgage. As this is a small amount compared to the loan, most lenders don’t mind this.

However, if your lender is not comfortable with rolling it into the mortgage, there are other ways to save up on the upfront costs.

Increasing your loan-to-value

Loan-to-value or LTV ratio describes the size of the loan that you take out compared to the sale price of the property.

Increasing your LTV essentially means that you take a higher loan amount and end up paying a lower downpayment. By doing so, you are left with extra money that you can use to pay the closing costs.

However, there are certain things that you need to consider when doing this.

Private Mortgage Insurance (PMI) may kick in

If you pay downpayment amount lower than 20 percent, you will likely have to pay PMI. PMI is the lender’s protection in the event that the buyer default in their mortgage payment and property gets foreclosed. PMI typically costs between 0.5 to 1 percent of the loan amount annually.

The loan-to-value (LTV) ratio is under the allowable limit

If your lender agrees to finance up to 90 percent of the home price, they may not go over that loan-to-value ratio, even to roll in closing costs.

However, many government-backed loans, such as FHA or VA, are set up specifically for the first time or lower-income home buyers. Here are the current financing limits on the type of loans.

| Loan Type | Maximum LTV |

|---|---|

| VA | Up to 100% |

| USDA | Up to 100% |

| FHA | Up to 96.5% |

| Conventional | Up to 97% |

The debt-to-income (DTI) ratio shouldn’t exceed the maximum allowable limit

The debt-to-income ratio compares a person’s monthly debt payment such as auto loans, credit cards, mortgage payments, rent, etc. to his or her monthly gross income.

The current DTI limit set by Fannie Mae is upto 50 percent for people with great credit and stable income. This essentially means that if your gross monthly income is $5,000, your monthly debt-related expenses must not exceed $2,500.

When you are taking a higher loan amount, you have to make sure that your DTI does not exceed this allowable limit.

Seller Concession

Seller concession is a formal arrangement in which the seller agrees to pay a portion, or all, of the closing costs at the time of closing.

In most cases, it looks like a gift, but they’re really just a legal way to allow you to include the closing costs in your mortgage.

Let’s say the house is selling for $300,000 and the closing cost is $12,000 or 4 percent of the sale price. In this case, the buyer will buy the house for $312,000 and the seller will give a concession of $12,000 to the buyer that can be used for paying the closing costs.

One caveat to this is that the house must appraise for the higher value. In this case, the appraised value needs to be $312,000 or more.

Also, keep in mind that there are limits to seller contribution on the loan type, property type and the downpayment amount.

Check out our entire article on What is Seller Concession; When and How to ask for one.

| Loan Type | Property Type | Downpayment | Maximum seller’s concession |

|---|---|---|---|

| FHA | Primary residence | Any | 6% |

| VA | Primary residence | Any | 4% |

| USDA | Primary residence | Any | 6% |

| Conventional | Primary residence or second home | Less than 10% | 3% |

| Conventional | Primary residence or second home | 10% to 25% | 6% |

| Conventional | Primary residence or second home | 25% or more | 9% |

| Conventional | Investment property | Any amount | 2% |

Should you Roll Closing Costs in a mortgage?

Well, it depends.

It is important to understand the consequences when you are including your closing costs into the mortgage.

If you choose to roll it in the loan amount, then you are paying interest on the closing cost for the entire loan period.

Let’s say you are buying a $300,000 home that requires you to put down $12,000 as closing costs during settlement. If you choose to roll this additional amount into your mortgage, you will end up paying $21,378 over the 30-year period considering a 4.3% rate.

Also, when you are taking a higher loan amount, your LTV increases. This will, in turn, reduce your stake in the property. When you look to sell your property in the future, you will end up making a lower profit.

By including closing costs into your mortgage, you will notice immediate benefits. However, you will end up paying much more over time.

Here are my two cents – If you are short on cash, and not able to pay the closing costs out of pocket, it is fine to include it in your mortgage; otherwise, paying it upfront is always the better alternative.

Are Closing Costs negotiable?

While there is no way for you to outright dodge paying closing costs, there are ways that you can pay considerably less.

According to HUD, the Real Estate Settlement Procedures Act seeks to reduce unnecessary high closing costs by requiring lenders to give you a “good faith estimate” (GFE) for the itemized list of fees. One thing to note here is that these are still “estimates”.

Some closing costs are negotiable such as title and attorney fees, commission rates, and recording fees. Also, watch out for miscellaneous fees like delivery and funding fees. If the fees seem vague, you may be able to lower or eliminate them.

As different lenders may have different requirements, the closing costs can vary widely. So before you finalize your mortgage, make sure to shop around.

Most people don’t realize that buying a home is going to be one of their most expensive purchases. Also, mortgage is one of the longest term loans that is out there. If you are considering a 30-year fixed mortgage, you’ll most likely be in touch with your lender for 30 years.

The lenders understand this, and they will try their best to get your business. This is your only opportunity to set the numbers, so give it your best to bring it down as much as you can.

Stay ahead in your financial journey by taking advantage of our most recommended tools and resources

Bonus tips to Reduce Closing Costs

Close at the end of the month

One of the simplest ways to reduce closing costs is to schedule your closing at the end of the month. This way you will be saving up on a lot on the prepaid interest which otherwise will be charged.

For instance, if you choose to close on the beginning of the month, say June 3rd, you will be paying prepaid interest for the rest of the month at closing. However, if you schedule it on June 29th instead, you will only have to pay one day of interest.

Lender’s Credit

This method is basically the reverse of Discount points.

You can ask your lender for credit in exchange of higher interest. So, if you are comfortable paying an additional 0.125% interest, you can get a 1% lender credit on the loan amount. For example, if your loan amount is $300,000, you can get a credit of $3,000 in exchange for an additional 0.125% interest rate.

However, note that you will end up paying $7,813 over the 30-year loan period for a credit of $3,000 in this case. Therefore, take into consideration the consequences before requesting for a lender’s credit.

Negotiate seller’s concession with Motivated seller

If the seller has a strong desire to abandon his or her property due to economic circumstances, you have basically struck gold. If it is a neutral or buyer’s market, you can not only negotiate on the listed price but also get the closing costs paid by the seller as well.

- Next Read – What is House Hacking? – A Beginner’s Guide